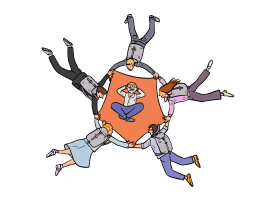

THE experts for reorganisations and restructuring

Sole entrepreneur, partnership, limited liability company, stock corporation or even Societas Europaea? Finding the right corporate form and structure is crucial element for the success of a business. Our long-term experience in the domestic and the international context and professional excellence help you to tax potentials and on this way, create a solid basis for profitable and efficient business activities.

Our interdisciplinary expert teams of tax advisors and lawyers combine their tax and legal knowledge and experience. Our one-stop shop offers you all-in-one package that is more than the sum of its parts. Our solutions are customised and comprehensive and can be implemented in an efficient manner. Our specialists benefit from long-term experience, and innovative approach in this area of advice.

Our services

- Analysis of existing or target corporate structures

- Customised reorganisation concepts (e.g. for business transfers or successions, pre- or post-acquisition, integration or spin-off of business units

- Obtaining binding rulings for reorganisations

- Implementation of reorganisations (e.g. divisions, contributions, relocation of head office, mergers, division of property)

- Preparation of tax and legal documents (in cooperation with lawyers) (e.g. balance sheets, audit of residual assets, contributions in kind, auditor confirmations, contracts, company register notifications)

- Reorganisation and transaction taxes (e.g. real estate transfer tax)

- Reorganisation-related reporting (e.g. transaction reporting to the tax office)

- Accounting of reorganisations and implementation in the accounting system

- Representation in tax procedures related to reorganisations