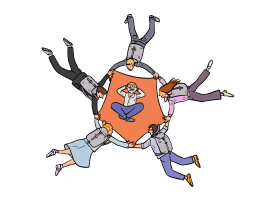

A new perspective for business succession

A good succession plan that is created at the right time represents one more great achievement of the entrepreneur who has succeeded in building his or her life’s work. A successful transfer provides the successors with a good basis for success and contributes to maintaining the integrity of the family business.

LeitnerLeitner supports you, your family and your company with comprehensive succession planning and implementation.

Whether you are considering an internal or external succession: tax advisors and lawyers work in well-coordinated, interdisciplinary and experienced teams to devise the tax and legal solutions that ensure that all participants benefit from an optimal and unassailable succession provision. Using the required empathy, we also take into account the relevant facts of the transferors and potential successors. We also support entrepreneurs with the implementation or adjustment of governance provisions.

Our services

- Interdisciplinary development of the legal and tax environment

- Consideration of all facts, including personal, through cross-generational social competence

- Long-term solutions designed to prevent disputes

- Valuation of your company or portions thereof

- Legal and best possible tax implementation of transfers

- Tax-optimised solutions for successors and transferors

- Development of employee participation solutions

- Support with acquisitions and disposals (preparation, structuring, due diligence, contract negotiations)

- Support with the further development of corporate governance, taking into account the special features of family businesses (review of corporate law provisions, agreements between shareholders, internal rules of procedure, shareholder information systems, family constitution, family value catalog, advisory board provisions etc.)